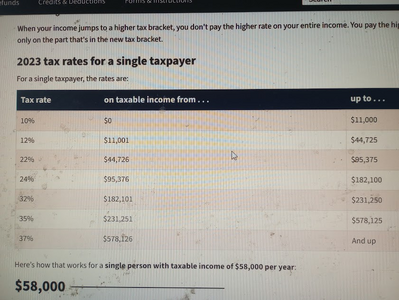

OK, I'm a tax preparer, so I will step in here. Bill G. is right about income being taxed based on the tax tables, but what people complain about is when there is a lot of overtime in a paycheck, the withholding is based on you earning that amount for the entire year (it often puts you in a higher tax bracket). This can make a substantial difference if you go from the 12 to 22% tax bracket for your overtime income.

However, if you don't work overtime all year long, you will likely get a lot of that higher withholding back when you file your tax return.

Also, based on the much higher standard deduction (under the Trump tax reform), in conjunction with the SALT tax deduction limitation, a lot fewer people are able to itemize deductions, it used to be far more common.

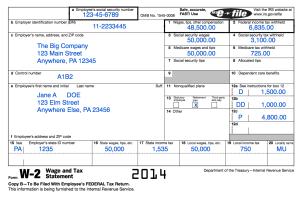

I'm sure that if they pass a rule not to tax overtime, it will be shown separately on your W-2.

Also, since I am 72, I also hope they don't tax Social Security. Way back when, it was NOT taxable. Then they started taxing up to 50% of it because they said the employer paid 1/2, not you. Then they said the amount you receive has increased based on inflation, so now they are allowed to tax up to 85% of it (based on your income, if you ONLY receive Social Security, it is not taxed).

But like my Father once said (he was both a Lawyer and Licensed Public Accountant and prepared tax returns) "It is unfair for them to change the rules in the middle of the game". My Dad was also a "notch" baby. For some reason, those born in that "notch" period received lower Social Security than those born either before or after. They never did correct it, and I'm sure they are all gone by now. He was born in 1919.

A little more trivia: When I started working in his office (when I was 14) my Dad did the taxes for this elderly couple. Her Social Security # was the same as his, except it had an "A" after it. After all, women did not work, people did not get divorced, so there was no reason to issue a separate #!

How things have changed!